The US economy is down 10 million jobs, roughly a 6% decline, from where it was one year ago. But the brunt of those job losses is being felt in two areas – the Northeast and West Coast.

New York, Massachusetts, New Jersey, California, and Nevada account for 40% of the nation’s job losses on their own. Each of those states has experienced a roughly 10% decline in jobs from its respective level one year ago.

Meanwhile, Flyover Country and the Sun Belt is much better off. Idaho is the top-performing state, with only a 1% decline in jobs, while Utah is in second at a 2%. Most of the other Flyover and Sun Belt states are in the 3-5% job loss range.

Another way to think about these figures is in a comparative fashion. New York’s 12% year-over-year job losses are:

- 6x higher than Utah

- 4x higher than Mississippi

- 3x higher than Arizona

- 2x higher than Florida

Those regional differences are astounding. And fairly unprecedented. The hardest-hit states in the Great Recession – Nevada and Arizona – only experienced job losses of roughly 7%.

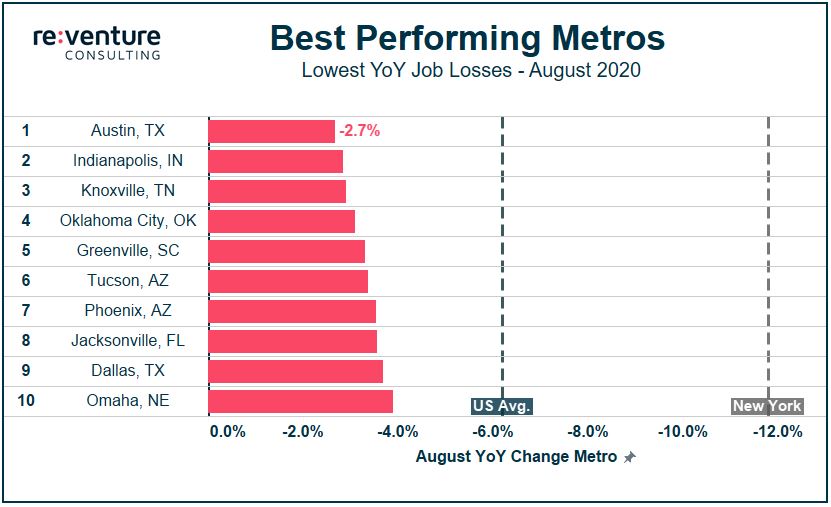

Similar comparisons can be made at the metro-level. Austin is the best performing large metro in the country, with only 2.7% YoY job losses, 5x better than the New York Metro, and over 2x better than the national average.

Two other marktes – Indianapolis and Knoxville – have kept their job losses below 3.0%. Markets like Tucson, Phoenix, and Dallas have kept them under 4.0%.

Meanwhile, the 10 worst performing metros have all logged job losses over 10% compared to one year ago.

The presence of Los Angeles, Boston, San Francisco, and New York shows the economic toll the recession has taken on Gateway markets in the Northeast and West Coast. There’s also an interesting presence of declining Northeast and Midwest Rust Belt cities – Detroit, Bridgeport, Cleveland, and Rochester – that show up on the list.

The Northeast and West Coast recession has interesting implications for real estate investment.

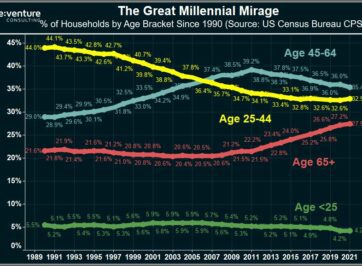

Generous fiscal stimulus payments have partially masked the impact of the job losses in these regions on local real estate markets. But as the stimulus subsides these areas will experience reduced household formation and lower consumer spending. Cash flows and values for multifamily and retail properties will drop as a result.

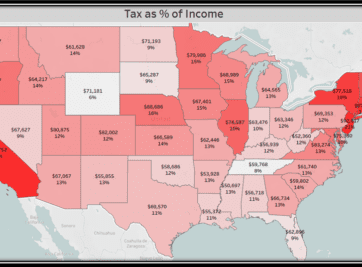

This could be a devastating blow to the real estate market in a place New York. The state was already suffering from an aging population, declining tax base, and elevated prices. Now introduce a depression-level employment shock. That’s a tough cocktail to recover from.

I’d be more optimistic about California. The state’s burgeoning tech scene and housing supply constraints create strong investment fundamentals. It also has a fairly young population.