90% Chance: RECESSION in 2022?

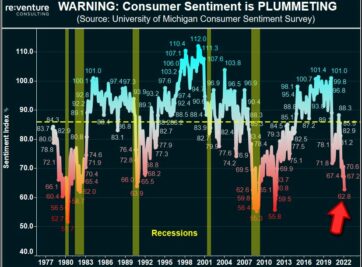

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

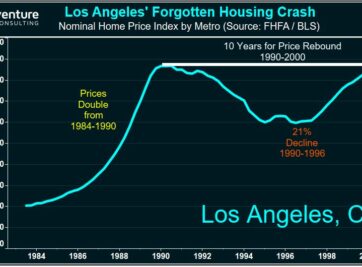

How bad will the 2021 Housing Crash be? Find out by looking back in history at the WORST Housing Crashes of all-time.

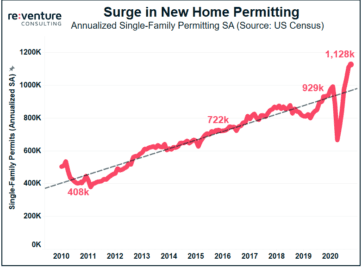

Many pundits try to argue that the US is facing a housing shortage crisis. These people are wrong. In fact, the demographic data says the exact opposite – that there is a shortage in DEMAND for homes.

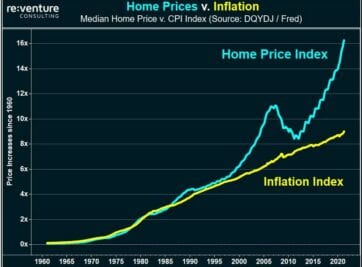

Prices in the US Housing Market are at record levels in 2021 relative to wages and inflation. Yet we’re in a deep economic recession. How could this be? Well, blame HGTV.

The US Housing Market is on the precipice of collapse. A unique combination of factors in 2020 led to surge in demand for homes along with a decline in supply. These factors will reverse by late 2021 and the Housing Market will crash.

Values in certain markets are beginning to detach from fundamentals. These markets are could be in a Bubble and should be approached cautiously.

The term “US Recession” should be replaced with “Northeast and West Coat Recession”. Those regions have job losses 2-3x higher than the rest of the country.

Want to understand the growth prospects of your real estate investment? Start by understanding the city’s Tradable sector.

Sign up to hear insights from Reventure