Let’s start off with some unemployment rate statistics (as of September 2020):

- 2.0% – Doctoral Degree

- 3.9% – Master’s

- 5.5% – Bachelor’s

- 8.6% – High School

- 9.5% – Some High School

Someone with a doctorate is over 4x more likely to have a job than someone with a high school diploma. Someone with a Bachelor’s degree is nearly 2x more likely to have a job than someone without a high school diploma.

And that’s only the start. For those who are employed, wages differ significantly as well (median weekly wage for full-time employees, 2019):

- $1,883 – Doctoral Degree

- $1,497 – Master’s

- $1,248 – Bachelor’s

- $746 – High School

- $592 – Some High School

So that doctoral degree recipient is also going to earn 2.5x more in their job than the high school graduate. Similarly, someone with a bachelor’s degree will make 2x more than someone without a high school diploma.

All of this paints a clear picture: educational attainment plays a massive role in economic outcomes across the country. Regions with higher educational attainment will benefit from better employment prospects and incomes. The reverse will be true for areas of lower attainment.

But just how much does educational attainment vary across the country?

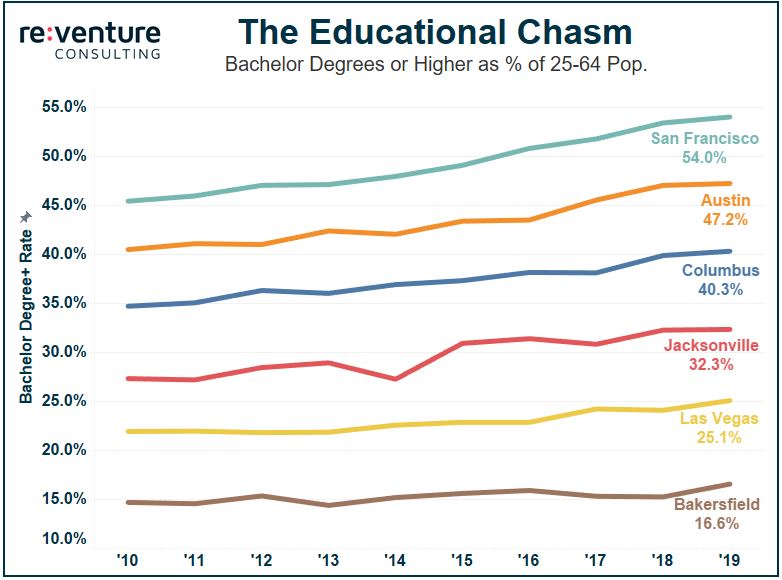

In a metro like San Francisco, one of the most educated areas of the country, 54% of working-age adults possess a bachelor’s degree or higher. At the other end of the spectrum is Bakersfield, only a four-hour drive south. The degree rate there is a mere 17%, one-third the level of San Francisco.

The rest of the country falls at various rungs in between. Austin (47.2%) and Columbus (40.3%) represent growing brain hubs with well above average degree rates. Meanwhile, Las Vegas (25.1%) has the second-lowest college degree rate of any metro with a population above 1 million. A place like Jacksonville (32.3%) falls around the US average.

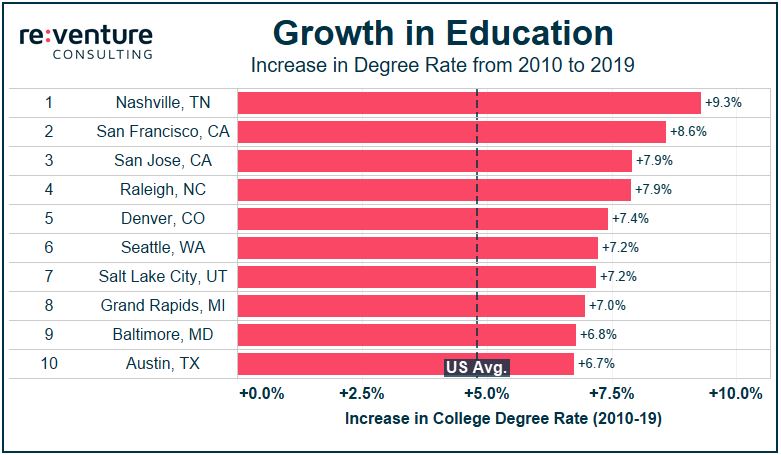

This chasm in educational attainment is growing. Since 2010 San Francisco added +8.6% to its college degree rate, while Austin added +6.8%. Yet Las Vegas and Bakersfield came in at only 3.8% and 1.9%, respectively.

In fact, of the 10 metros with the highest growth in college degree rate, only two (Salt Lake and Grand Rapids) had a below-average rate in 2010. This means that educational attainment is clustering in areas where it already exists, driven by the migration of educated people towards these metros.

Now let’s think back to the unemployment and wage data from the beginning of the post. College degrees equate to jobs and income. If degrees are clustering in specific brain hub metros, those areas will likely have better and more secure economic outcomes going forward.

What does this all mean for real estate?

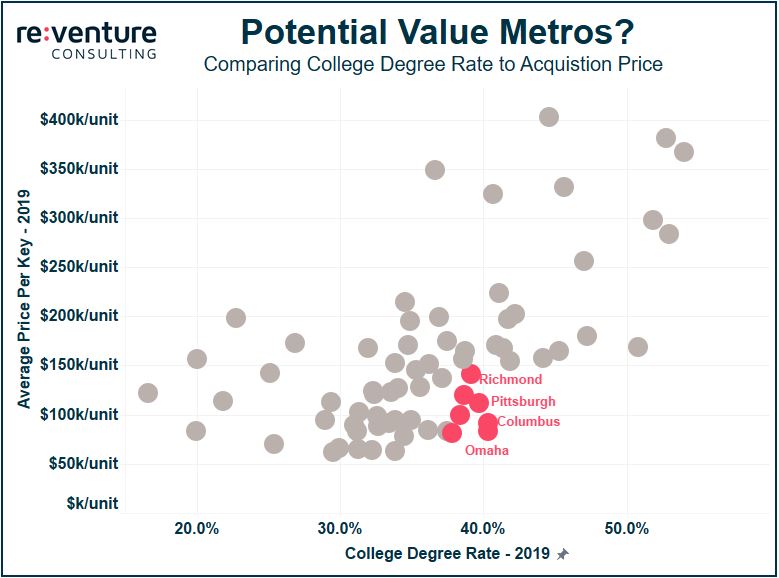

Obviously real estate owners want to be in areas with a secure economy and strong future growth prospects, so one potential strategy is to target metros that are brain hubs. San Francisco, San Jose, Raleigh, Denver, Seattle, and Austin fit the bill. The fundamentals of real estate demand (jobs and income) are likely very strong in these markets.

The issue is that everyone wants to be in these markets, so the price to gain entry is high (although Raleigh is actually quite affordable compared to the rest). Another option would be to consider markets that are above average in educational attainment but more affordable to gain entry into.

The red dots in the graph above highlight markets that meet three criteria: >37.5% degree rate, >4.5% degree growth, and average acquisition price <$150k/unit. Richmond, Pittsburgh, Columbus, and Omaha stand out as some potential value metros based on their higher share of educational attainment mixed with affordability.

*Unemployment and wage data at beginning of the post sourced from BLS

E-mail Reventure Consulting to learn more about how the data presented in this article can help your real estate company make smarter investment decisions.