Picking the right investment market is the single most important decision a multifamily or residential real estate investor can make. Invest in the right market and you will ride the glorious wave of rent growth and value appreciation. You will make money. Your investors and lenders will make money. You will grow your real estate business.

Invest in the wrong market? Well, that’s setting yourself up for stagnating – or perhaps even declining – rents and values. You will make significantly less money, as will your investors. It will be difficult to grow your real estate business.

Ultimately picking the right investment market is a Million Dollar Decision. Or, in some cases, a 25 Million Dollar Decision. Read below to see why.

Let’s turn back the clock to 2014. Imagine you’re a multifamily real estate investor trying to decide which markets to target for your acquisitions strategy. You keep hearing about two markets in discussions with brokers:

Both of these markets are garnering high praise from the investment community. Philadelphia, as a hub of finance and higher education, looks bullet proof and poised for continuous growth. Phoenix is one of the fastest-growing cities in the country. You decide to get some data to compare these markets and see that they have almost identical cap rates – 6.1% for Phoenix and 6.2% for Philadelphia.

“Great! The investment consensus is saying these markets are roughly equivalent in risk and growth potential. We will diversify our strategy and pursue acquisitions in each market.”

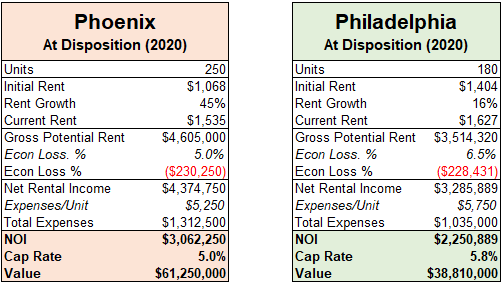

Over the next year you buy one multifamily deal in each market – each a roughly $30 million acquisition. The in-place proforma from each acquisition is below:

Note that rents in Phoenix at the time of acquisition were $1,068/unit/mo. compared to $1,404 in Philadelphia. Economic loss in each market was identical at 6.0%, while expenses were slightly higher in Philadelphia. The net result, however, was a similar $1.9 million of income and $30 million value at each asset.

“Wow, our investors are pleased with these acquisitions! They’re looking forward to receiving their return in five years when we sell both assets.”

But something interesting begins to happen over the years. The asset in Phoenix starts performing exceptionally well – with high occupancy rates and huge rent increases each year, while the one in Philadelphia begins to lag. Sure enough, five years later, you look at the historical rent growth chart from Zillow for each market and see the reason for the diverging performances.

“Wow! Rent growth in Phoenix has totaled 45% over the last six years! But in Philadelphia it’s nearly three times less at 16%. That explains a lot!”

The vast differences in rent growth mean that the Phoenix property’s average rent is now all the way up to $1,535/unit/mo., while Philadelphia’s is only up to $1,627. You’re getting ready to market the two properties for sale and run an updated proforma.

“Holy smokes! Based on all that rent growth as well as some vacancy compression, NOI is now all the way up to $3.0 million! And based on the significant cap rate compression in the market (6.1% –> 5.0%), our asset in Phoenix is now worth $61 million! Its value has more than doubled in six years! We just created $30 million in equity value for us and our investors!”

Philadelphia, one the other hand, doesn’t look so hot. Based on the meager rent growth and only a moderate decline in cap rates (6.0% –> 5.8%), the asset there is now worth $39 million today – a roughly $8 million increase in value. Its NOI of $2.2 million is more than $800k lower than Phoenix after starting out at the same point.

“Our investors in Phoenix are really happy with the current income and distributions. We’re actually going to hold onto the Phoenix asset instead of sell it. We’re also going to sell our asset in Philadelphia and buy another one in Phoenix!”

Our hypothetical investor has made several very costly mistakes over the last five years. Let’s outline them below:

No Market-Based Acquisitions Strategy: our investor never formulated a market-based investment strategy. They simply went off word of mouth from brokers with a quick sanity check on cap rates. The result is that our investor was essentially flying blind into markets where they were making $30 million decisions.

Diversification “Strategy”: for the sake of geographic diversification, the investor pursued deals in each market. While pursuing diversification might seem wise on the surface, it’s ultimately the strategy of a firm without a real strategy. Buying an asset in Philadelphia instead of an additional one in Phoenix came at an opportunity cost of $25+ million in cash flow and value.

No Market-Based Dispositions Strategy: seduced by the strong returns in Phoenix, the investor decided to hold onto their asset there and even buy another one in the market. While this might have been the wise decision in 2015, it doesn’t necessarily mean it is in 2020. In fact, the exact opposite could be true now. Perhaps Phoenix is approaching bubble territory and Philadelphia now shows some compelling value? The firm has no way of knowing because they still haven’t formulated an investment strategy.

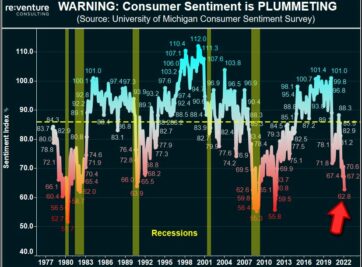

Markets oscillate in three to five year investment cycles. In one cycle the market could be poised for growth. In the other it could be poised for stagnation. Usually (but not always) after a market achieves a growth cycle it enters a stagnation cycle as developers and investors from around the country/world flock to chase its previous growth. Unfortunately for them, they’re getting in at precisely the wrong time.

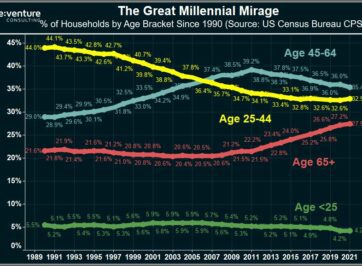

In the example above Phoenix was on the precipice of a growth cycle in 2014. Philadelphia was on the verge of a stagnation cycle. Evaluating data on household formation, building permits, as well as rent affordability could have clued our hypothetical investor into this reality.

Reventure Consulting helps real estate investors identify and predict market cycles with an investment strategy based on fundamentals. These fundamentals start with tracking the Holy Trinity of real estate growth:

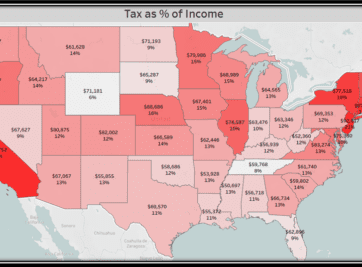

- Affordability

- Demographic Growth

- Restricted Supply

Markets that meet the Holy Trinity criteria are poised for significant rent and value growth while offering downside protection. Ones that fail to meet these criteria are destined for stagnation and volatility.

Contact Reventure Consulting today to learn more about how we can help you formulate an investment strategy that will deliver higher returns to you and your investors.