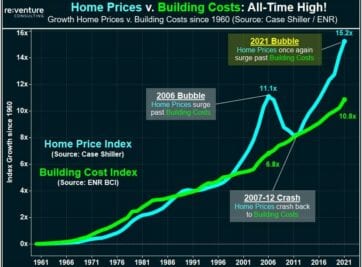

The terms Housing Bubble and Market Crash get thrown around very casually these days. And I typically hate alarmist rhetoric like that. But unfortunately, there are some real signs pointing to the US Housing Market being significantly overheated and on the precipice of a crash that could occur by late 2021.

Let’s use data to explore these points.

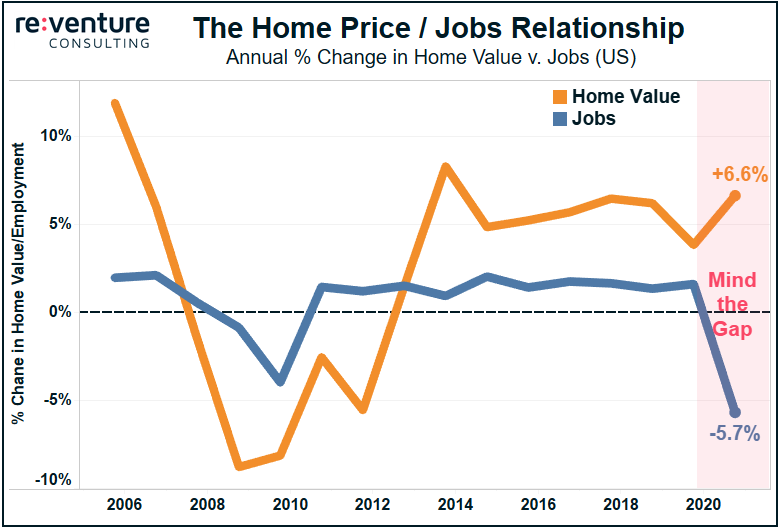

Issue #1: Rising Prices, Declining Jobs

The jobs and income growth created by a healthy economy tend to spill over into the housing market. As a result, fundamental economic variables like employment are correlated to home values. That is, when jobs go up, home values go up, and vice versa.

However, that relationship has broken down in 2020.

The average price of a home in the US, as measured by Zillow, increased increased by 6.6% in 2020. Meanwhile, employment across the country, as measured by the Bureau of Labor Statistics, declined by -5.7%.

So, we have to ask: if the US economy is suffering, with jobs and income declining, what is propelling housing prices higher?

Issue #2: Unsustainable Demand

Over the last 12 months, 5.9 million households moved into a home (from Q3 2019 to Q3 2020). That is the single largest annual increase ever, and roughly 2-3x the increases experienced during the mid-2000s bubble.

The experiences of COVID, combined with low interest rates, increased the desirability of owning a home. So, en masse, lots of first-time buyers made the decision to take the plunge into Home Ownership. Many of these buyers were likely set to buy a home in 2021 or 2022, but because of COVID and low interest rates, accelerated the decision into 2020. This surge of demand is what has enabled home prices to increase even in the midst of a recession.

The issue is that the demand surge is totally unsustainable. After all, there are only so many households in the US that a) want to own a home, b) can afford the down payment, and c) meet the credit standards.

As a result, the demand for homes in 2021 is very likely to decline.

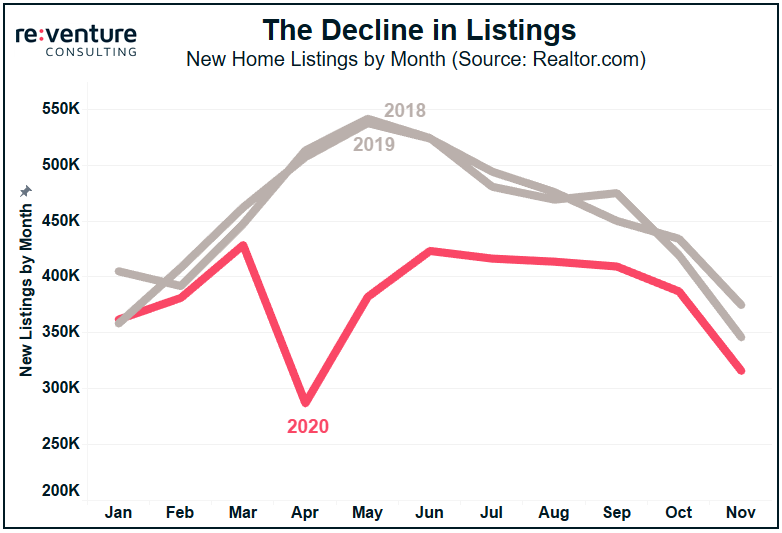

Issue #3: The Listing Bounceback

Just as demand spiked from first-time buyers piling into 2020, supply was constrained by existing home owners putting off their decision to sell. Consider that in a typical April/May, the peak season for house listings, the US sees as many 550k new homes listed for sale.

This year that figure plummeted by 50%.

The decline in listing supply has heavily constrained for-sale inventory, putting significant upward pressure on prices. But, similar to the demand issue discussed above, the listing dip is temporary in nature.

The shortfall in new listings has declined as 2020 progressed (closing gap between the grey and red lines above). Expect this gap to continue to close through early 2021 and then reverse next spring, as record-high home prices and the comfort of a COVID vaccine induce many delayed sellers to finally list their homes.

But there’s another supply headwind the housing market will face…

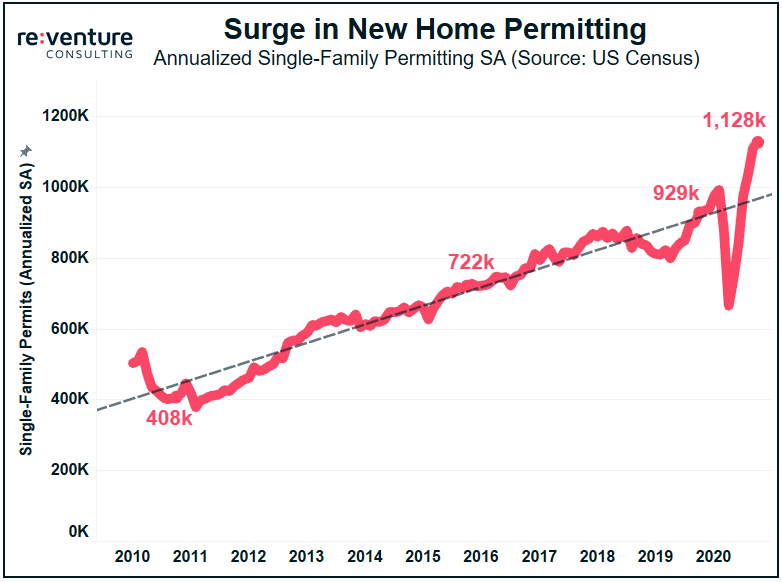

Issue #4: Home Building Continues

Despite the supply chain disruptions and material price spikes during COVID, permitting for new single-family homes has surged in late 2020.

In October 2020 builders drew permits for a 1.1 million new single-family housing units (annualized / seasonally adjusted). Compare that to:

- 408k in 2010 (65% lower)

- 722k in 2015 (35% lower)

- 929k in 2019 (18% lower)

Units permitted today are typically delivered in 6-12 months time, meaning there will be a surge of new homes for sale across the US in late 2021.

So, just as more existing owners are deciding to list their homes for sales, significantly more new homes will enter the market for sale as well.

Let’s recap.

Home prices have continued to climb despite a deterioration in US economic fundamentals. This was enabled by a temporary increase in the demand for housing combined with a temporary decrease in the supply of homes for sale. Both of these trends are expected to reverse in 2021 as the pool of home buyers dwindles while cautious sellers re-enter the market. Just as this occurs, home builders will deliver a glut of new for-sale inventory into the market.

That’s the recipe for a housing crash.

The exact timing of the crash will be difficult to predict. I suspect late 2021 but a variety of factors could prolong the unsustainable expansion of home prices, namely:

- Speculation: animal spirits could overtake the market, with investors and speculators stepping in to buy homes with the intention of selling for profit at a later date. This type of activity kept the mid-2000s Housing Bubble afloat for longer than expected.

- Softening in Lender Underwriting Standards: if lenders begin to allow lower down payments or lower their credit standards then this could increase the prospective home buyer pool, further stimulating demand. This is also something that occurred in the mid-2000s.

- Government Support for Housing Market: the Biden administration has already floated the idea of a first-time home buyer tax credit. This type of policy would also expand the home buyer pool and stimulate demand. A similar policy was used in the late 2000s to prop up the housing market.

While these factors might keep the appreciation train rolling for longer than expected, they are ultimately powerless to prevent the inevitable retrenchment in prices back to fundamentals more closely tied to jobs and income.

One additional point to consider is that certain markets are more at risk of a crash than others. We’ll explore this concept more in future posts. Stay tuned.

Reventure Consulting uses high-end data analytics to advise real estate owners, developers, and lenders on the best locations to invest their capital. Reach out today to learn more about how Reventure can help you achieve better returns.