We’re now firmly entrenched in 2021. People are doing their best to look forward and forget the trials and tribulations of the previous year. But for real estate investors there is no such luxury. Understanding the recent trends in growth and appreciation is paramount for staying ahead of the curve and maintaining a sound investment strategy.

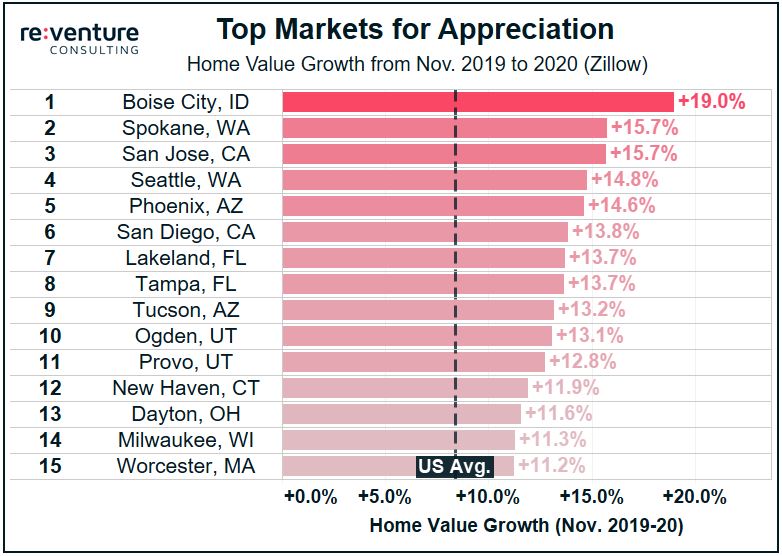

Despite the recession and pandemic, real estate values in 2020 went through the roof. The average market grew values at +8.4% in 2020, but with significant variation surrounding that average. In this post we will break down the Best and Worst performing real estate markets of 2020 and provide insight into what to expect for them going forward.

The Best Markets

Let’s start off with the fun stuff: the Best Markets. Those with the most appreciation in 2020 according to Zillow. Investors in these markets experienced value appreciation of over 10% in the previous year – some even approaching 20%. But the million dollar question surrounding these markets is: Will the growth last?

- Boise: Kicking ass and taking names. That’s what Boise did in 2020. The average price of a home increased by an astounding 19%, from $310k to $370k. Existing real estate owners are very pleased no doubt. Buyers, on the other hand? They’re not as impressed. One has to wonder if Boise could be experiencing the beginnings of a housing bubble, as its $370k average value is now higher than more established markets like Austin and Phoenix.

- San Jose: I thought Silicon Valley was supposed to be in decline? San Jose, even in the face of a stiff drop in rental rates, still managed to increase values by over 15% in 2020. That brings the average price of a home across the metro to a gaudy $1.3 million, the highest in the country. But don’t bet on the increases to keep coming. The structural weakness in San Jose’s rental market will likely spillover to reduce values at some point.

- Phoenix: Definitely the most divisive market out there. Some investors love it. Others hate it, fearing a re-run of the late 2000s housing bust. My take is somewhere in between. Phoenix’s economy has matured significantly over the last 10 years while its permitting of new housing is much lower. That’s a cocktail for value growth. With that said, now might not be the best time to get in after the market just experienced +15% appreciation in one year.

- Tucson: The little market that could. While it’s big brother Phoenix gets all the fanfare, Tucson has delivered similar returns over the last half-decade at more reasonable price points. The key? Tucson is 1) affordable, 2) growing, and 3) doesn’t build too many new homes. With an average price of $246k, it still offers investors a decent value proposition.

- Ogden / Provo: These are the metros directly to the north / south of Salt Lake City. Both are extremely young with lots of organic population growth and inward migration. Both also benefit from geographic constraints that will limit long-term supply expansion. But short-term supply growth? Well, there’s lots of that. Both markets are permitting a lot of new housing units – particularly Provo. That could mean an ugly decline in values if things go south.

- New Haven / Dayton / Milwaukee / Worcester: The runts of the litter, so to speak. While Boise, Phoenix, and Provo get all the attention from institutional real estate investors, no one seems to care about a sleepy rust-belt market like New Haven or Milwaukee. But no one caring can be a good thing. That means there’s virtually no new supply being delivered in these markets, putting upward pressure on prices.

Prudent investors should be cautious entering any of the above markets right now. Seeing growth rates like +15% is a warning flag. Regardless of the underlying fundamentals, those levels of appreciation are impossible to sustain. If you do want to chase growth, do it in the markets that are affordable and permitting fewer new housing units (Spokane, Tucson, Milwaukee). Their fundamentals are on firmer footing.

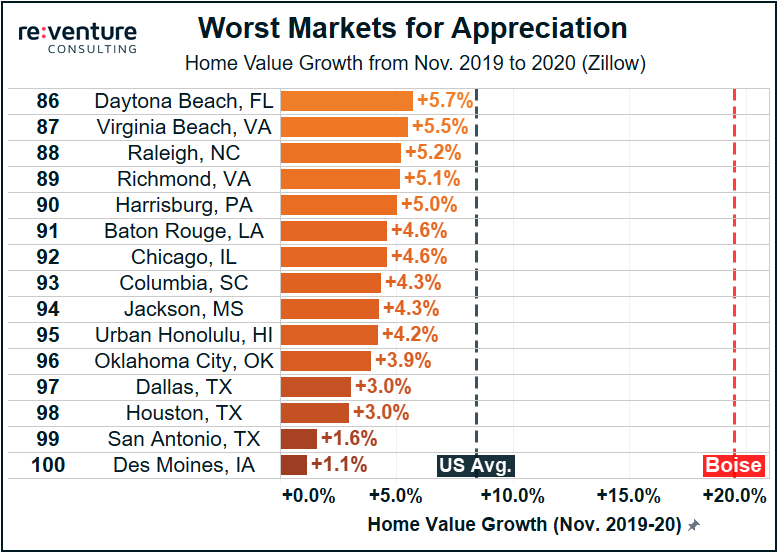

The Worst Markets

Now to turn our attention to the dogs. The markets that struggled to take part in the housing market boom of 2020. Most of these markets came in at appreciation rates of 3-5%, solid for normal times but ultimately lacking when other markets were putting up 15%+.

- Raleigh: Despite being one of the most beloved growth markets among institutional real estate investors, Raleigh has a dirty little secret: low appreciation. Not just in 2020, but also going back over the last five years. The issue is related to supply, as Raleigh has been an aggressive permitter of new housing. The excess permitting keeps homes affordable and appreciation in check, even in the face of significant gains in income and population.

- Chicago: Does anyone want to invest in a market with population declines, job losses, and low rent growth? Didn’t think so. And that’s probably why Chicago has struggled significantly over the last decade. The Windy City looks to be in secular decline and it’s difficult to see a path forward for future growth. The upshot is that developers have stopped paying attention to it in recent years. That could translate to price stability and potentially some appreciation in 3-5 years time.

- Oklahoma City: This is a perplexing market. It’s affordable, fast-growing, and has limited supply expansion. But yet rents and value have struggled to grow. What gives? To be honest, I’m not sure. But I would bank on Oklahoma City experiencing stronger growth the next 5 years than it did the previous 5 years.

- Dallas/Houston: Now here’s a shocker. Dallas and Houston – two of the largest and fastest-growing markets in the US – are laggards in terms of real estate value growth. Not to beat a dead horse, but once again this goes back to supply expansion. Dallas and Houston permit 3x more new housing units each year than other markets of comparable size. All of these new units mean that the markets err more on the side of a Housing Glut than a Housing Shortage.

- San Antonio: Can you remember back to circa-2014? San Antonio was all the rage. Every investor wanted a piece. But not anymore. And a lot of that has to do with its neighbor 1-hour to the north: Austin. In the competition to keep and attract young Texans, Austin is winning, siphoning much of San Antonio’s upwardly mobile population. The result is that San Antonio’s growth rates are slowing. That means lower real estate appreciation.

Just because a market had low real estate appreciation in 2020 doesn’t mean it’s a bad market to invest in. It could just mean the market is “slow and steady”. This more manageable rate of growth will likely make these markets more durable during a downturn, and more likely to achieve growth coming out of a downturn. Maybe Slow and Steady wins the race?

Reventure Consulting provides predictive analytics to real estate owners, developers, and lenders looking for the locations to invest their capital. Reach out today to learn more about how Reventure can help you achieve better returns.