90% Chance: RECESSION in 2022?

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

April 2020 will go down as the worst monthly economic decline in US history. Compared to one year earlier the country lost an astounding 20 million jobs. The nation’s unemployment rate spiked from 3.6% to a post-Great Depression high of 14.7%.

But focusing on the national figures obscures the tremendous variability in economic outcomes across the US. The depression-level job losses across the Northeast and Midwest greatly exceed the fairly mild declines in the Sun Belt. For example, Detroit and New York lost 3x more jobs in April than Salt Lake City and Dallas.

The relative economic impact in these cities has been masked due to generous fiscal stimulus. But these benefits will eventually be reduced or run out entirely. When that occurs there will be significant pressure for populations and businesses to move southward and westward, an acceleration of a trend that was already occurring over the last 10 years.

Regional real estate markets will begin to shoulder the burden of this geographic shift. Rust Belt towns throughout the Midwest and Northeast could struggle with high vacancy rates and higher cap rates. Meanwhile, Sun Belt areas will likely benefit from higher rent growth and cap rate compression.

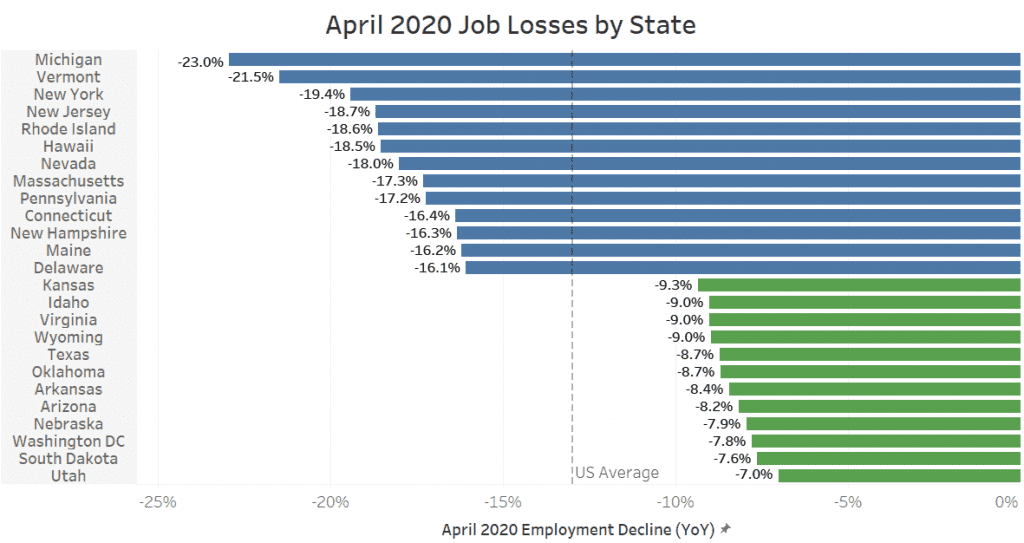

The United States lost 13% of its jobs in April 2020 compared to one year earlier. Yet those losses were distributed unevenly across the country.

Michigan experienced an astounding 23% year-over-year decline in jobs. New York saw a 19% reduction. Other job loss leaders include Vermont, New Jersey, Rhode Island, Massachusetts, Pennsylvania, and Connecticut – all northeast states. Hawaii and Nevada, economies heavily reliant on tourism, also experienced sizable employment declines.

Meanwhile, Utah only lost 7% of its jobs, more than one-third lower than Michigan. Arizona, Arkansas, Oklahoma, and Texas also measured more moderate job losses. The areas that fared the best economically were primarily situated in the Sun Belt or Rural Western regions like South Dakota, Wyoming, and Idaho.

The severity of each state’s COVID outbreak played a significant role in determining the extent of its employment decline. This effect is displayed on the graph below, with the color of each bar corresponding to COVID Deaths/Capita (dark blue = more deaths).

States with higher COVID deaths – Michigan, New York, New Jersey, and Rhode Island – generally had more job losses. States with minimal COVID impact – the Sun Belt and Rural Western states – lost fewer jobs.

It’s likely that the higher population densities and colder weather of Midwest and Northeast states will put them at a continued disadvantage in their efforts to contain virus spread. As a result, the relative differences in economic health outlined in April will likely persist even as employment recovers.

But there’s more to recent regional economic issues than simply COVID spread. Evaluating job losses on a metro-level reveals that Rust Belt areas, even ones without significant COVID spread, have been the most negatively impacted economically.

Of the 25 metros with the largest employment declines, 17 are Rust Belt regions. These areas tend to be heavily manufacturing-based and experienced decades of economic stagnation as the US economy shifted to a service-based model.

Many were making strides to recovery. Cities like Buffalo, NY and Akron, OH lowered their unemployment rates close to the US average of 3.5% in February. But continued reliance on manufacturing and a lack of high-skilled jobs left them especially vulnerable to an economic shock like the COVID crisis.

Cities like New York, Boston, and Philadelphia, despite also experiencing heavy April job losses, are strong innovation centers that produce high-value goods and services. These areas will likely bounce-back sooner than the Rust Belt areas outlined above.

Of the 25 metros that have displayed the most employment resiliency, all but two reside in Sun Belt regions. All of these metros kept year over year job losses below 10%. Ogden, UT even managed to keep them below 5%. These declines appear relatively modest compared to Detroit’s 24% reduction.

The Utah trio of MSAs – Salt Lake, Ogden, and Provo – weathered the COVID storm well. In addition to lacking population density and being warm, these areas are also very young (median age of 31). These factors attract growth in normal times and will even more so because of COVID.

The entire state of Texas also kept job losses to a minimum. Texas, like Utah, combines sprawl, warm weather, and a relatively young population.

The varying regional impact of job losses hasn’t been felt yet due to federal fiscal stimulus. But at some point, the stimulus will be reduced, or run out entirely. When that occurs residential and retail demand should drop relative to employment declines.

Cap rates in hard-hit Rust Belt cities could increase by 100-200bps. Rent growth will likely turn negative in the short-term and tepid in the long-run. Sun Belt markets will also experience pain in the near future as 5-10% employment declines are still significant.

But in the intermediate term Sun Belt real estate markets will benefit from a new set of people and businesses looking for improved economic prospects. The resulting migration will put upward pressure on rents and downward pressure on cap rates.

Sign up to hear insights from Reventure