90% Chance: RECESSION in 2022?

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

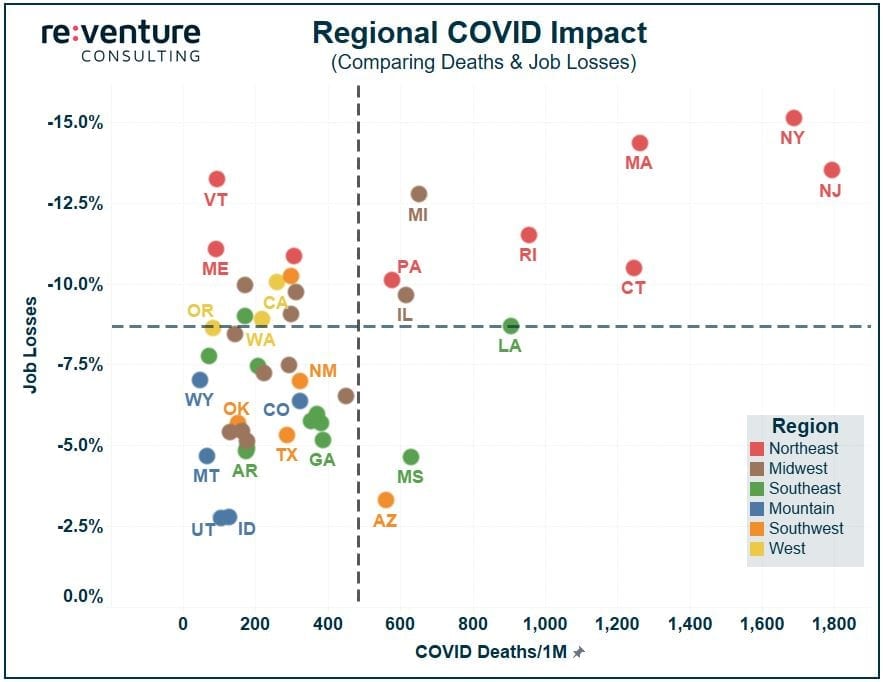

The June jobs report, released by the Bureau of Labor Statistics earlier this month, confirmed a trend that has existed since the COVID crisis began: markets in the Northeast are bearing the brunt of the current recession. Collectively, employment in Northeast states has declined by over 13%.

The Mountain region, comprised of Colorado, Utah, Idaho, Wyoming, and Montana, is the best performing part of the country with only a 4.8% employment decline (nearly 3x lower than the Northeast). Southwest and Southeast states aren’t far off with 5.5% to 6.0% job loss figures.

The severity of the Northeast’s COVID outbreak is likely a driving force behind its economic devastation. High COVID cases and deaths resulted in increased social distancing and lower consumer spending, shuttering small businesses in hospitality, event planning, marketing, and food/beverage.

However, the underlying economic impacts of these business closings and job losses haven’t been truly felt in local Northeast economies due to CARES Act federal stimulus, which provides unemployed individuals with $600 per week on top of state benefits. This stimulus was so strong that is resulted in an 11% increase in personal incomes in April despite record-setting job losses.

As the federal stimulus wanes, expect on-time rent payments to decline and lower household formation as the unemployed move in with friends and family. The result will be increased multifamily vacancy and bad debt. The retail market will also struggle as lower consumer spending squeezes operator margins.

Certain markets in the Northeast are more impacted than others. New York and Massachusetts are the worst-impacted states, accounting for the top four job loss markets as well as eight of the top 11. Springfield, MA leads the nation with a 15.6% employment decline with New York, NY coming in second at 15.4%.

Pennsylvania is significantly less impacted, with five metros (Allentown, Harrisburg, York, Lancaster & Reading) all registering job losses below the US average. Pittsburgh and Philadelphia, the state’s two biggest markets, came in slightly above the US average but still well below its other Northeast peers.

The longer elevated job losses persist across the Northeast, the more long-term harm will be caused to these regional economies. Extensive academic literature documents the devastating impacts of long-term unemployment (greater than six months) on individuals and their surrounding communities. We’re now in the 4-5 month range for most job losses. Unless the Northeast rebounds soon, it could be set for an extended period of economic malaise that ultimately dampens real estate markets for the next half-decade.

Sign up to hear insights from Reventure