90% Chance: RECESSION in 2022?

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

The Multifamily asset class has remained resilient despite numerous headwinds in 2020. In the face of job losses, COVID shutdowns, and social unrest, the industry is still buoyant. According to Zillow, average rent growth measures 2.5% year over year through September 2020.

This figure is well above the headline inflation rate of 1.4% and is only a slight decline from the levels achieved from 2018 to 2019. Considering the issues that multifamily has been forced to adapt to over the last six months, 2.5% rent growth should be considered a win for the asset class and a testament to the durability of its demand base.

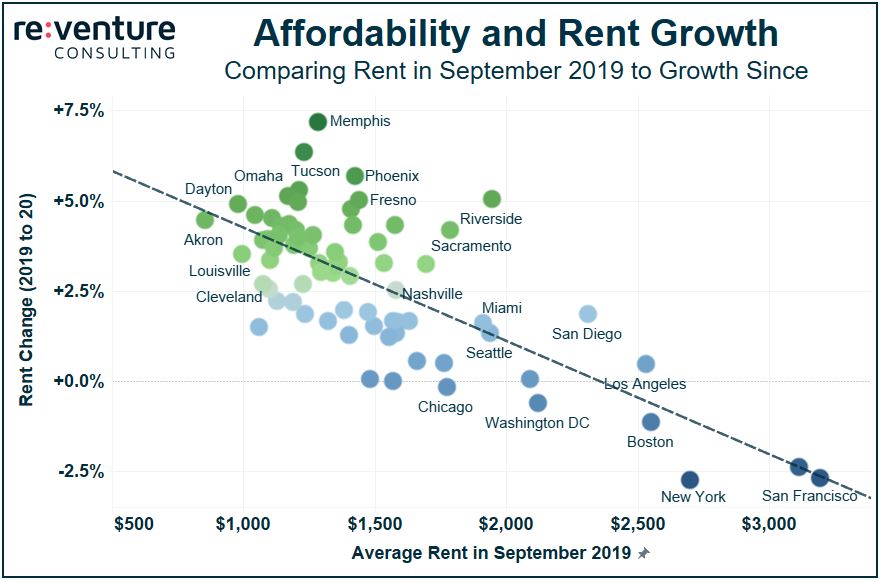

Of course, 2.5% is merely an average across markets. Individually speaking, certain markets grew rent at a much faster level, while others trailed. Gateway Metros such as New York, San Francisco, and Boston were part of the handful of regions that experienced rent declines and dragged down the overall average.

But most markets experienced positive movement. 93% saw some type of rent growth, while 75% grew rent above the headline inflation rate. On top of that, nearly half the markets achieved rent growth above 3.0%, a common proforma growth assumption.

What’s more, a selection of high-performing markets managed to hit rent growth synonymous with levels experienced in the economic expansion of previous years.

Memphis led all metros with 7.2% rent growth year over year through September, with average rents in the market increasing from $1,282/mo. to $1,374/mo. Phoenix came in second at 5.7%, marking its third straight year topping the 5.0% threshold. Other top-performing markets include Tucson, Riverside, and Fresno, highlighting the resilience of the Southwest multifamily demand base.

Omaha, Indianapolis, Dayton, Buffalo, and Kansas City round out the rest of the top 10, giving the Midwest strong representation. Some of these markets fell out of favor with multifamily investors in recent years due to declining demographics. Expect them to garner more attention now that they’re achieving 4.0%+ rent growth in the midst of a recession.

While the Southwest and Midwest couldn’t seem more different in certain ways, they share one key trait: they’re affordable. Over the last 12 months affordability, even more so than job losses or supply increases, has been the leading factor behind market rent growth.

The trend in the graph above is clear: markets with affordable rents have experienced higher rent growth over the last 12 months (upper left portion of the graph). They are predominantly located in the Southwest and Midwest regions of the country. Meanwhile, markets with higher rents – mostly situated on the coasts – have experienced slower growth or even rent declines (bottom right).

It remains to be seen if this trend continues to hold into the future. However, in the interim, multifamily investors should take solace in the fact despite difficult social and economic conditions, the asset class’ rent growth has remained solid. And in many parts of the country – particularly the Southwest and Midwest – it has been more than solid. It’s been great.

Sign up to hear insights from Reventure