90% Chance: RECESSION in 2022?

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

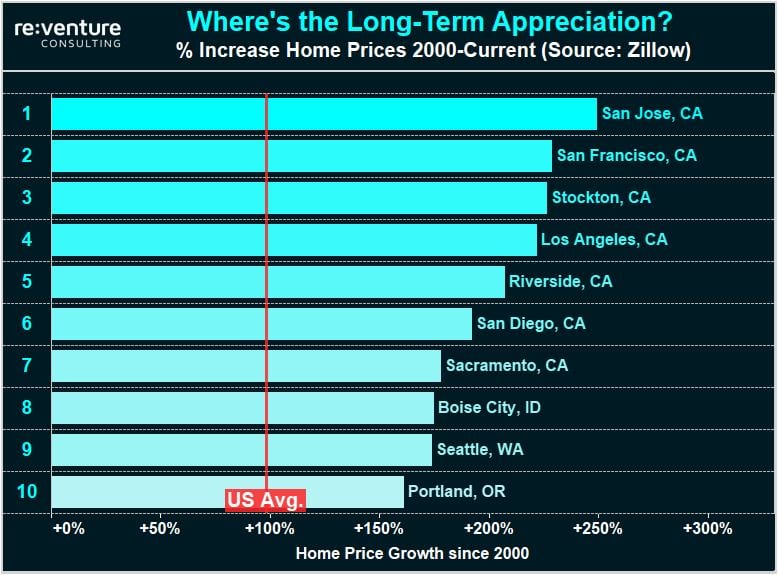

California has produced massive returns for real estate investors over the last two decades. Home owners, real estate developers, and local landlords have experienced huge appreciation and rental rate increases.

But many are now questioning whether this record run of growth will continue. California’s high cost of living, slowing economy, and burdensome government regulation are causing many people and businesses to flee the state.

This leaves many wondering: is California set for a Housing Crash in 2021?

Despite all of the headwinds it has faced in recent years, California has delivered the best returns for real estate owners over the past two decades. To see what I’m talking check out the graph below.

The top 7 appreciation markets across the country since 2000 are located in California. Home prices in these markets have gone up by over +200% (meaning they have more than tripled) over the last two decades. Here are some examples showing how the typical home price in each market has grown:

These levels of growth are quite simply absurd, more than doubling the US average growth rate of +98% (red line above). Anyone who has invested in California real estate over the last two decades has probably done very well for themselves.

Now this begs an interesting question: Why is real estate getting so expensive in California, especially if so many people are deciding to leave the state? Is this growth justified, or is California entering a Housing Bubble that is about to crash?

To answer that question we need to address the elephant in the room: California’s housing shortage.

A good way to get a sense of a market’s housing shortage is to look at how many new housing units are permitted for construction. Dividing the amount of new permits by the metro’s total job count – a figure I call Permit % – gives an even clearer perspective.

San Francisco’s Permit % in early 2021 is a measly 0.5% – calculated by dividing 11,500 permits pulled over the previous 12 months by the metro’s 2.2 million job count. San Diego is at a similar level. These cities aren’t coming close to permitting enough new housing to satisfy the demand from their economies.

This becomes especially clear when you compare them to Austin and Nashville. Austin has permitted 45,000 new housing units over the previous 12 months on a job count of 1.1 million (4.1%). Nashville is at 27,000 on 1.0 million – good for 2.6%.

This means that San Francisco and San Diego are permitting 5-7x fewer new housing units for construction than Austin and Nashville. No wonder there’s a housing shortage in California!

But one has to wonder just how long this can go on for, even accounting for the housing shortage. After all, people only have so much money to spend on housing. And the more they get squeezed, the more likely they are to leave the state or the default on their obligations to pay. Neither would be good for the local real estate market.

To get a sense of just how expensive California has become take a look at the graph below, which tracks Value / Earnings Ratio across San Francisco, San Diego, Austin, and Nashville. This metric is calculated by taking the typical home price in each market and dividing it by the annual earnings of the average worker.

In San Francisco the typical home price is an astounding 15x compared to the annual earnings of a typical worker. In San Diego it’s 12x. These are extremely high levels indicating that middle-class households in these California markets are being priced out of home ownership. Meanwhile, Value / Earnings in Austin is 8x and Nashville is 6x, much more affordable levels.

Notice that decline in Value / Earnings ratio that occurred in San Francisco and San Diego from 2007 to 2012. Prices got cut by 30-40% in these markets in that time frame. It’s possible that a similar situation could occur over the next couple years as real estate prices re-align to levels that are more closely aligned with incomes.

So what can real estate investors expect in California going forward? I think there’s a short-term and long-term outlook. In the short-term it’s likely that prices will decline from the absurd highs that they’re currently at. I wouldn’t be shocked by 20-30% corrections in some markets over the next several years.

But over the long run the outlook is more bullish. California’s housing shortage crisis is continually worsening as NIMBY attitudes prevail and developers continue to leave the state. That type of environment will sow the seeds for continued long-term real estate growth.

If you’re a home buyer or real estate developer in California and would like to discuss how Reventure Consulting can help you use data to make better investment decisions, please reach out using the contact form below.

If you are interested in real estate investing and want to learn more about Reventure Consulting’s 1-on-1 coaching program, please fill out of the contact form below!

Sign up to hear insights from Reventure