90% Chance: RECESSION in 2022?

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

Want to gain an edge in finding the best growth markets and improving your real estate returns? It’s time to start using Business Formation data. This data set, which is tracked at the county-level by the US Census, provides a lens into future economic and real estate growth.

The beauty of Business Formation is that its a forward-looking indicator – that is, an indicator that predicts future growth. How? Well, once a business is formed, it typically takes 3 to 5 years for this business to grow enough to make a meaningful impact on the local economy. As a result, tracking changes in Business Formation today provides insight into what the real economy – jobs, income, and population – will look like a half-decade into the future.

Accessing this knowledge allows real estate investors to get ahead of the curve and buy into promising growth markets before prices get bid up. Such an investment strategy will provide for superior real estate returns. This post will analyze how to use Business Formation data to pick the market in Florida poised for the most future growth.

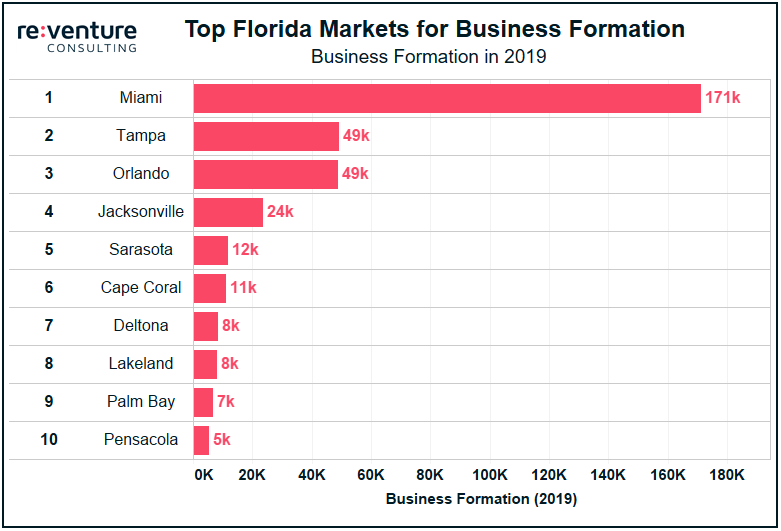

The best place to start is to establish context. What Florida markets have the highest level of annual Business Formation? The graph below answers this questions by looking at 2019 Business Formation across Florida’s 10 largest metros.

Miami laps the field with 171k formations in 2019, with more than 3x the level of 2nd place Tampa. Its evident that a majority of the future economic growth that occurs in Florida will be in Miami, as well as Tampa, Orlando, and Jacksonville to a lesser extent.

But there’s more to the story. Miami’s metro population exceeds 6 million, 2x higher than Tampa and 4x higher than Jacksonville. As a result of its higher population, Miami requires more Business Formation in order to sustain economic growth. In order to create an apples to apples comparison, we should evaluate Business Formation on a per capita basis.

We can see that dynamic of the per capita rankings have changed slightly. Miami’s lead over the rest of Florida has narrowed by quite a bit, however it is still comfortably number one. Meanwhile, Jacksonville now looks much closer to Orlando and Tampa than it did previously.

Not surprisingly, everyone already knows Miami is the most dynamic economy in Florida. That’s why the average price of a home is 30% higher in Miami compared to Tampa. Real estate investors need to pay a higher price to get a piece of the dynamic growth that Miami offers.

But could other markets be flying under the radar? This is where its helpful to analyze changes in Business Formation over time. Perhaps there’s several markets that are undervalued relative to the amount of future growth in the local economy?

The graph below shows the markets in Florida with the largest increases in annual Business Formation from 2014 to 2019.

Now we’re getting somewhere. Whereas Lakeland and Pensacola were towards the bottom of the list in Business Formation per Capita, they are at the top in Business growth. That makes them intriguing markets to target for real estate investment.

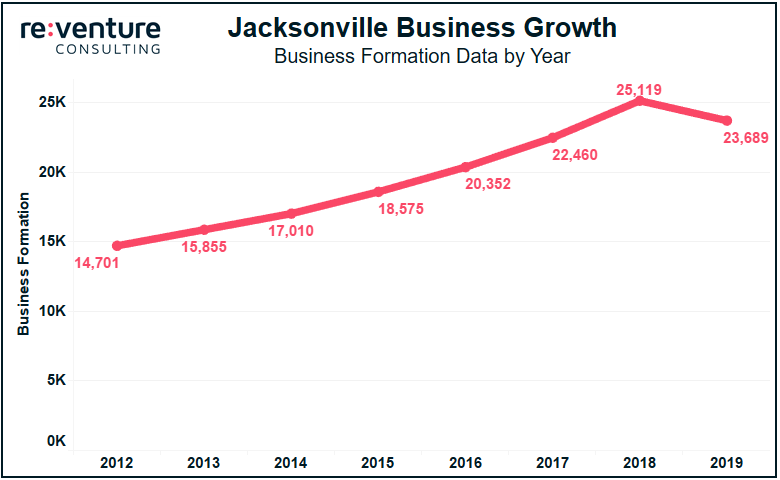

Another intriguing market is Jacksonville. It ranked 4th in Formations per capita and is 2nd in Formation growth since 2014 at +50%.

Let’s put that in perspective for a second – Jacksonville was averaging around 15k Business Formations per year back in the early 2010s. That figure shot up to 23k by 2019.

Let’s assume that 75% of the additional 8,000 businesses formed in Jacksonville each year go nowhere. And that the remaining 2,000 businesses reach the US small business average of 10 employees over the next five years. That’s an additional 20,000 jobs per year being added to Jacksonville’s economy in the near future!

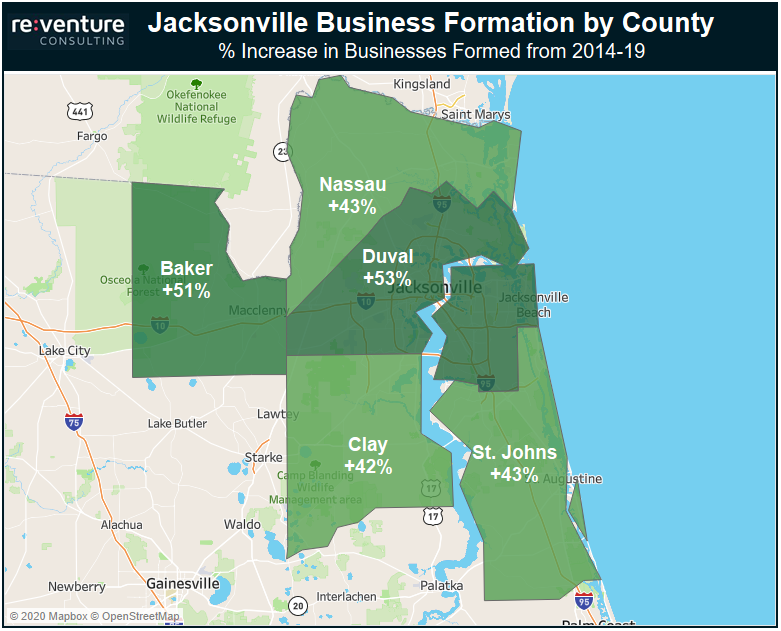

To take this analysis on step further, let’s break down these gains by county.

Duval, the county that surrounds Jacksonville’s inner loop, experienced the most growth at +53%. Outlying counties like Nassau, Clay, and St. Johns came in around +43%. This shows that the growth in Business Formation, and thus the future economic growth of Jacksonville, is fairly well spread out throughout the metro. However, the highest levels of job and income expansion are likely to occur in Duval County.

Using Business Formation data allowed us to identify Jacksonville as a market with strong prospects for real estate investment. It’s growth in Business Formation was nearly 2x higher than Miami’s despite the average price of a home being 30% lower. We should expect rents and values in Jacksonville to grow over the long run as the jobs and income produced by these new businesses permeates into the real estate market.

Reventure Consulting uses high-end data analytics to advise real estate owners, developers, and lenders on the best locations to invest their capital. Reach out today to learn more about how Reventure can help you achieve better returns.

Sign up to hear insights from Reventure