90% Chance: RECESSION in 2022?

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

Austin real estate and home prices have gone through the roof over the last decade. So much so that the housing market is now in a Bubble that is about to come crashing down. There are three main reasons why no one should invest in Austin real estate right now.

Before we get into those reasons, I suspect you might be already thinking: “Nick, what are you talking about!? Austin is the hottest market in the country! Tesla, Elon Musk, Oracle, Joe Rogan – everyone and anyone is moving there!”

Damn straight. Austin is an amazing city with legitimate economic growth. It has a lot of inward migration and corporate relocations, things that are good for the local real estate market. I even moved to Austin last year. It has a lot of good things going on.

But Austin’s overall profile, as well as that of its real estate market, is kind of like a trending Instagram post. It’s getting a lot of likes and re-shares. It’s going viral all over the web. But, at some point, the hype will fade. And when that happens the dark realities of Austin’s real estate market will come to light.

The three reasons no one should invest in Austin real estate right now are: 1) Unsustainable Appreciation, 2) Future Housing Glut, and 3) Rental Market Softness. Let’s tackle these one by one so that, if you are a home buyer or real estate investor in Austin, you have the full picture of what’s going on in the market.

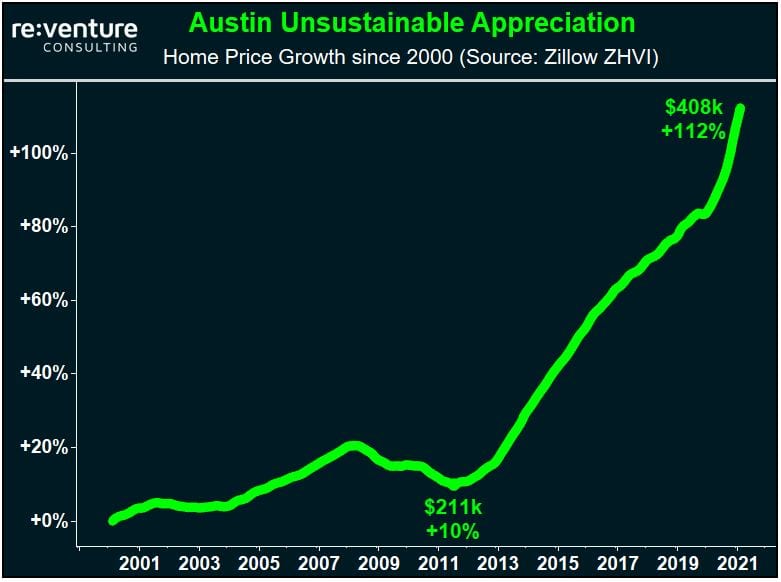

To understand the recent run up in Austin home prices – to a metro average of $408k for the typical home in February 2021 – it’s important to look back into history. How much have home prices gone up in recent years? How much have they gone up over the long term?

Let’s wind back the clock to 2000. The year of Y2K and the Tech Bubble. All the way back then the typical price of a home in Austin was a reasonable $192k. Over the next decade home prices in Austin floundered. By 2011 the typical price of a home sat at $211k, a pitiful +10% increase.

It’s important to wrap your head around this reality. Austin, for all the press and positive fanfare it receives today, was a poor real estate investment for much of its recent history. The main reason for this is that Austin, on the basis of being a fast-growing city in Texas, permitted and built a ton of new housing units every year. Such high levels of building kept inventory high and price growth low.

But something changed after 2011. All of a sudden prices in Austin began to skyrocket. And they just kept going up. All the way to the $408k level we see today, which is +112% higher than levels in 2000. What happened? Why did Austin’s real estate market go from being a laggard to one of the best in the country?

Real estate is all about Supply and Demand. The balance between homes on the market for sale (supply) and the growth inward migration and jobs (demand) in the local economy. Austin has produced very consistent demand over the last 20-30 years, always being among the US leaders in job growth. But its supply story is more complicated.

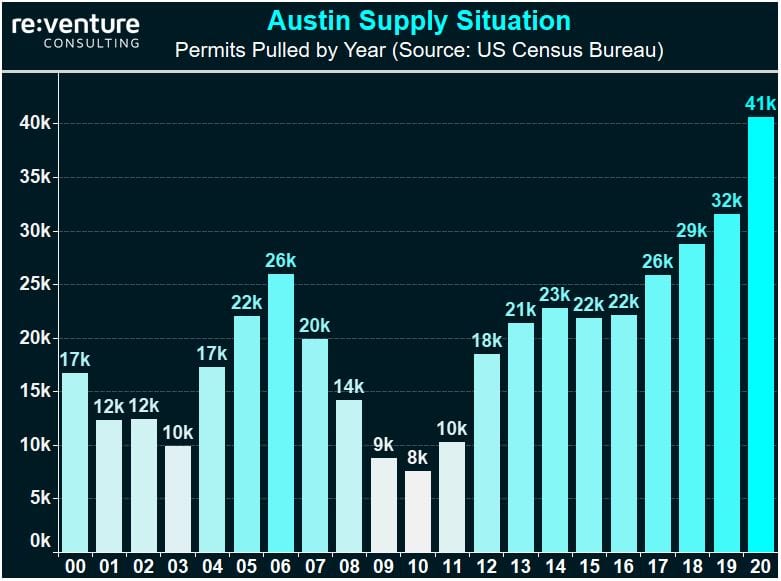

In the mid-2000s Austin was permitting lots of new homes and apartments, with 20-25k permits pulled each year. These permits turned into completed units in the 1-2 years after the permit was pulled. The high permitting resulted in a high supply of housing, keeping appreciation low.

But permitting crashed in Austin from 2008 to 2011, as it did in most parts of the country. This caused a deficit in new housing construction, which ultimately led to upward pressure on prices in the first half of the 2010s.

But now Austin has overcorrected in the other direction. In 2020 Austin permitted a record 41k new homes and apartments for construction over the next several years. As I discussed in a previous post, that’s more than any other large metro in the country on a relative basis.

This permitting is a window into the future – a glimpse into what Austin’s inventory situation will look like in late 2021 / early 2022. Expect both for-sale and rental inventory to rise significantly between now and then, which will put downward pressure on prices and rents.

Lost in the shuffle of Austin’s red-hot housing market is that the rental side of things has struggled over the last year. Ask any landlord in Austin and they will tell you that it is difficult to find tenants. Rents are being cut and generous concessions being offered. The causes for this are twofold: 1) the increase in permitting from 2017-19 has resulted in a deluge of vacant, luxury apartment units and 2) many renters became home owners over the last year.

The issues being felt in Austin’s rental market will eventually impact home prices. For starters, renters who were considering a home purchase will be more inclined to renew their lease if the landlord is offering a generous rental concession. Especially when the cost and headache of buying a home is climbing. This will deprive the local housing market of the record demand it received in 2020.

But perhaps the biggest impact will come via listing supply. A significant percentage of homes and townhomes in Austin are owned by investors who rent out their property for cash flow. These investors are starting to experience issues finding tenants. Many of their properties are sitting vacant, with the landlord footing the bill for property taxes and mortgage interest out of pocket. Combine their struggling rental business with record-high prices and many of these investor owners will feel compelled to sell.

Combine the increase in newly permitted homes with an increase in investor-owner listings and all of a sudden inventory could spike significantly over the next year. Not to mention the potential surge in listings from COVID-cautious sellers who waited for the pandemic to abate before selling, as well as the inevitable spike in foreclosures when the moratorium ends.

This inventory spike will come just as the home-buying demand subsides from the sweetheart rental deals that tenants are getting all across the city.

It’s at this juncture – probably sometime in early 2022 – when Austin’s 10 year run of crazy price appreciation will come to an end. The real question is just how far prices will have to fall.

We’ll cover that in a future article. Until then, please follow Reventure Consulting on both YouTube and Instagram, where I produce real estate content every single day.

If you are interested in real estate investing and want to learn more about Reventure Consulting’s 1-on-1 coaching program, please fill out of the contact form below!

Sign up to hear insights from Reventure