90% Chance: RECESSION in 2022?

Oil Prices are Surging. Consumer Sentiment is Crashing. The odds of a 2022 Recession have SKYROCKETED in recent months.

The Housing Market is red hot to start off 2021. Interest rates are at record lows. Your friends are starting to buy homes and investment properties. You’re starting to a get a lot of FOMO. “I can’t miss out on this! I need to get in on the action and buy something!”

Right? Wrong!

Making huge financial decisions based on this type of thinking is a great way to lose money. The last thing a real estate investor wants to do is buy at the top of the market. Especially in a city with deteriorating economic fundamentals.

This post will highlight several cities that real estate investors should avoid buying into in 2021. If you’re a first-time home buyer in these cities it would be wise to rent for a little longer. If you’re a real estate investor then look at other cities for your investment.

When I advise clients to avoid Austin the first response is shock and disbelief.

“Don’t buy in Austin? Are you crazy!? Oracle is moving their HQ to Austin and the city is getting all types of job and population growth. It’s the hottest market in the country.”

The issue with Austin is precisely that – it’s the hottest market in the country. As a result, every real estate developer and home builder is tripping over themselves to build new apartments and single-family homes there. The result of this developer feeding-frenzy is that Austin is permitting more new housing than any other city in the country.

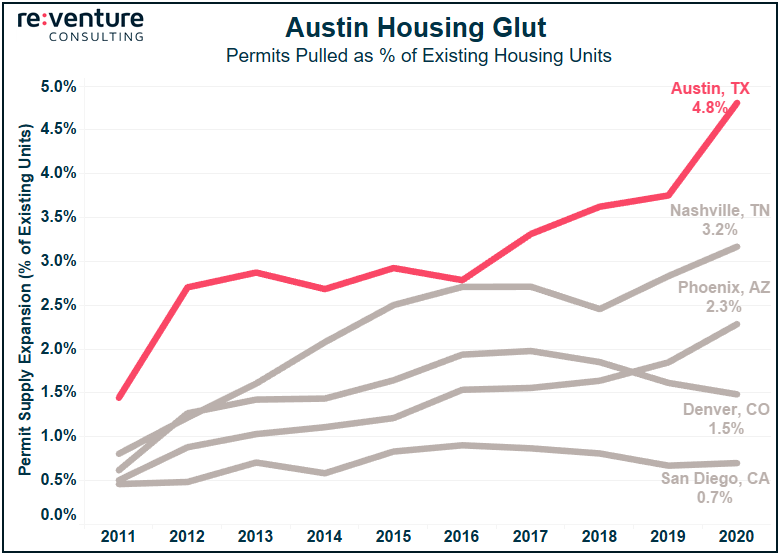

Developers in the Austin metro area have pulled 42k permits in 2020, representing a 4.8% expansion of housing supply. For some context, Austin’s 2020 permitting expansion is 2x higher than Phoenix, 3x higher than Denver, and 7x higher than San Diego.

This is vast expansion in new permitting is setting Austin up for a Housing Glut sometime in mid-to-late 2021. This will slow growth and potentially put the city on the precipice of a real estate bubble.

New Orleans is a market that tends to fly under the radar. People think of it more as a place to visit rather than a place to buy real estate. And that’s a good thing, because New Orleans’ economy has the unenviable designation of suffering from both long and short term stagnation.

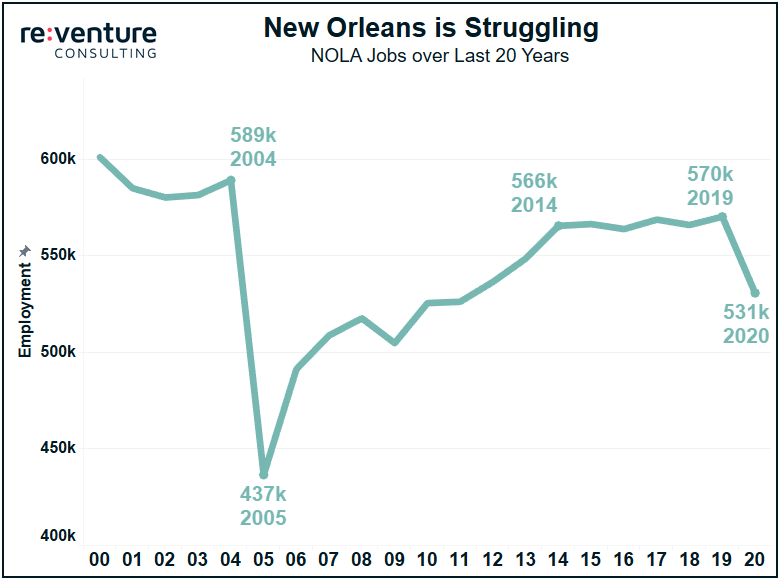

Long-Term Stagnation: The city has never recovered from the devastating impacts of Hurricane Katrina in August 2005. Prior to Katrina the New Orleans metro area had 589k jobs. Immediately after the jobs figure plummeted by astounding 25%. The city has still yet to grow jobs back to pre-Katrina levels.

Short-Term Issues: If long-run stagnation wasn’t enough, New Orleans also suffered tremendously in 2020. COVID ravaged the city and job losses were severe, amounting to nearly 40k through the end of the year.

In the end a city needs to create jobs in order to have a growing real estate market. If a city is losing jobs, both in the long and short term, then it’s best for home buyers and investors to look elswhere.

“Don’t worry about New York City. It will bounce back! It always has!”

This is a common argument you’ll hear among real estate investors who are bullish on the long-term prospects of New York City despite record job losses and outward migration in 2020.

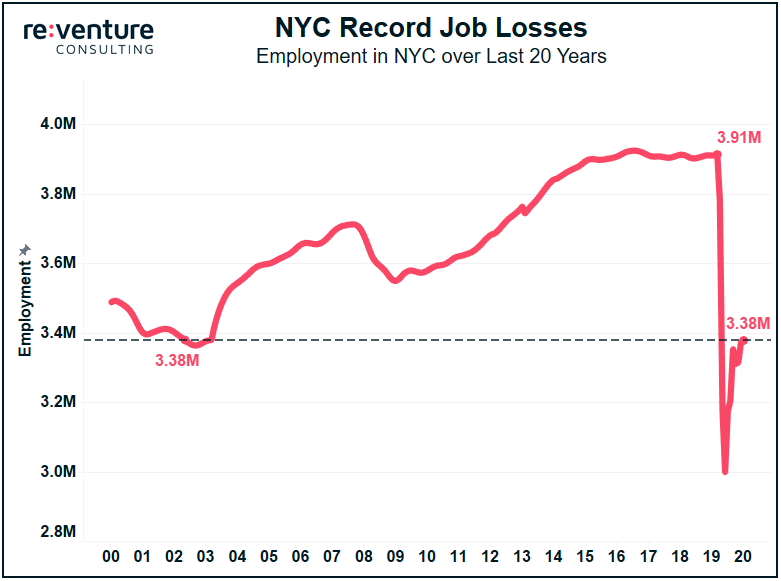

It’s tempting to believe this argument – after all, New York bounced back from 9/11 and the Financial Crisis. However, applying some scrutiny to the numbers reveals that New York City has never faced anything like this before.

The city has lost over 13% of its jobs in 2020, declining from 3.91 million early in the year to 3.38 million by December. That type of decline is unprecedented.

The last time the city had 3.38 million jobs was in 2002 – 18 years ago! Now think about how much real estate has been built and renovated since then. That’s a lot of vacant units. Stay away.

Los Angeles shares some similar traits to New York City in how badly its economy has been impacted over the last year. However, that’s not the main reason you should avoid Los Angeles real estate.

The real problem facing Los Angeles real estate is a lack of affordability. According to data from Zillow, the typical home in Los Angeles costs $740k in December 2020. That’s the 3rd highest price across the country, bested only by San Jose and San Francisco.

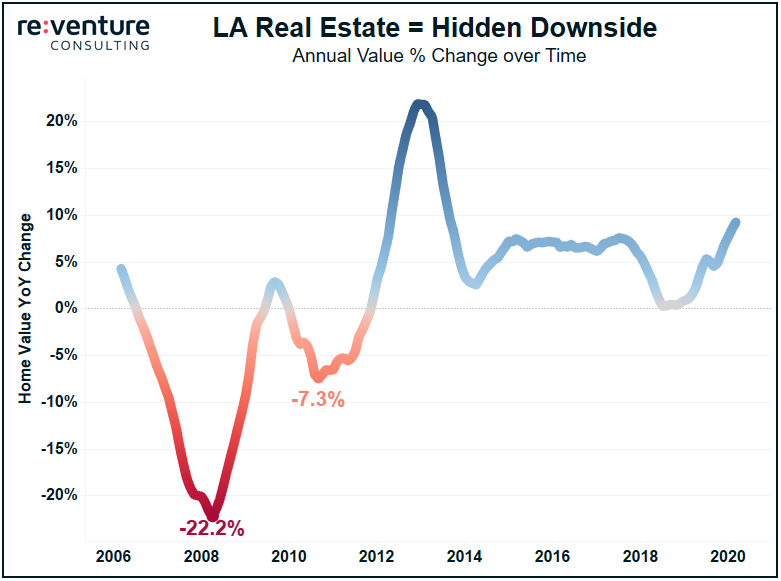

The issue for Los Angeles is that income levels don’t support the home prices. And when values start going far above what income levels can support, that typically means there’s hidden downside risk.

That downside became very apparent during the late 2000s housing crash. Real estate prices across Los Angeles declined by over 20% in 2008. And they declined by another 7% in 2010. Many real estate investors were completely wiped out.

Could we see a repeat of that in 2021? Stay tuned.

Reventure Consulting uses high-end data analytics to advise real estate owners, developers, and lenders on the best locations to invest their capital. Reach out today to learn more about how Reventure can help you achieve better returns.

Sign up to hear insights from Reventure